A Savings Account is a deposit account held in a bank or other financial institution that provides principal security and a standard interest rate. Checks are not written from a Standard Saving Account, in hence, maintaining a standard interest rate on Principal Amount. An Account Holder of a Standard Savings Account has the authority to perform Direct Withdrawal of Funds from their accounts whenever without any fees or charges. Interest rates on a Standard Savings account is based on the range of its Principal Amount.

- Globally, all banks requires two forms of identification to open a basic Savings Account.

There is No Mandatory Deposit requirements on a Standard Savings Account as long as the balance is more than $0.00.

Depending on other specific type of savings account, the account holder may not be able to write checks from the account (without incurring extra fees or expenses) and the account is likely to have a limited number of free transfers/transactions. Savings account funds are considered one of the most solid investments inside of Demand Deposit accounts and cash.

In contrast to savings accounts, Checking Accounts allow you to write checks and use electronic debit to access your funds inside the account. Savings accounts are generally for money that you don’t intend to use for daily expenses. To open a savings account, simply go down to your local bank with proper identification and ask to open an account.

Because savings accounts always pay moderate interest rates as compare to the terms of Treasury bills and certificates of deposit, they should be used for long-term holding periods likewise. Their main advantages are readiness, liquidity and superior rates compared to checking accounts. Most modern savings accounts offer access to funds through visits to a local branch, over the internet and through Automated Teller Machines (ATM).

Banks and credit unions typically offer basic savings accounts, holding the money on account for the depositor. The Financial Institution (FI) pays interest on the balance. Savings accounts are very safe because the Federal Deposit Insurance Corporation (FDIC) insures them for up to $250,000.00.

Depositors may be required to withdraw funds from their savings account for a specific number of times per month or at any time. Financial institutions pay regulated and rangeable interest rates on savings account balances. If the main concern is earning interest, not liquidity, Treasury bills and certificates of deposits are better long-term investments than savings accounts.

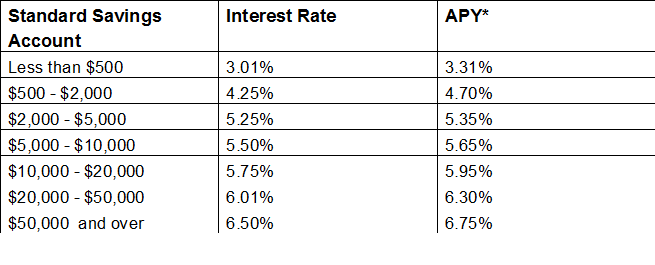

| Standard Savings Account | Interest Rate | APY* |

| Less than $500 | 3.01% | 3.31% |

| $500 – $2,000 | 4.25% | 4.70% |

| $2,000 – $5,000 | 5.25% | 5.35% |

| $5,000 – $10,000 | 5.50% | 5.65% |

| $10,000 – $20,000 | 5.75% | 5.95% |

| $20,000 – $50,000 | 6.01% | 6.30% |

| $50,000 and over | 6.50% | 6.75% |

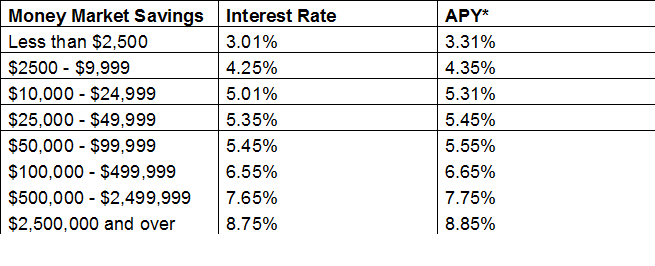

Money Market Interest Ratings –

| Money Market Savings | Interest Rate | APY* |

| Less than $2,500 | 3.01% | 3.31% |

| $2500 – $9,999 | 4.25% | 4.35% |

| $10,000 – $24,999 | 5.01% | 5.31% |

| $25,000 – $49,999 | 5.35% | 5.45% |

| $50,000 – $99,999 | 5.45% | 5.55% |

| $100,000 – $499,999 | 6.55% | 6.65% |

| $500,000 – $2,499,999 | 7.65% | 7.75% |

| $2,500,000 and over | 8.75% | 8.85% |

The main advantage of a savings account over a checking account is that the savings account offers almost the same liquidity, but also pays interest. With the advent of ATM machines and online banking, it has become increasingly easy for depositors to transfer money between accounts. If a depositor has both a savings account and a checking account, the depositor could effectively have an interest-bearing checking account simply by keeping the bulk of his money in the savings account, and then making periodic transfers from the savings account to the checking account to cover payments drawn on the checking account. Because of this ease in transferring funds, some financial institutions limit the amount of withdrawals per month that can be made from a savings account.

Finally, the aggregate total of all savings account balances in the United States are included in the calculation of the money supply.

APY vs. Rate of Return

In an investment scenario, rate of return is simply the amount by which an investment grows over a specified time period, expressed as a percentage of the original investment amount. Rates of return can be difficult to compare across different investment vehicles, especially when such vehicles feature different compounding periods. For example, one investment vehicle compounds interest monthly, another compounds quarterly, another biannually and lastly, one compounds interest only once per year.

Comparing these rates of return by simply restating each percentage value over one year gives an inaccurate result, as it ignores the effects of compounding interest. The shorter the compounding period, the faster the investment grows, since at the end of each compounding period, interest earned over the period is added to principal balance, and future interest is calculated on the larger principal.

APY standardizes each rate of return not only by restating it over one year but by adjusting the rate of return to assume a one-year compounding period.